The English Premier League (EPL) started its 34th season last weekend with most of the pundits focusing on the top of the table and whether Arne Slot’s Liverpool can retain the title in the face of a rejuvenated challenge by Pep Guardiola’s Manchester City. Relatively little attention has been given to the chances of the newly promoted clubs – Leeds United, Burnley and Sunderland – avoiding relegation with most pundits tipping all three to follow their predecessors in the last two seasons in being immediately relegated back to the Championship. The opening weekend of the EPL season went somewhat against the doom merchants with two of the three newly promoted clubs, Sunderland and Leeds United, winning. This is the first time that two newly promoted clubs have won their first game since Brentford and Watford in 2021/22 with the only other instance of this rare feat being Bolton Wanderers and Crystal Palace in 1997/98 although it should be noted that only Brentford then went on to avoid relegation. I must of course in the interests of objectivity declare my allegiances – I have lived and worked in Leeds for over 40 years and, as a Scot growing up in the 1960s, my “English” team was always Leeds United, then packed with Scottish internationals with Billy Bremner and Eddie Gray my particular favourites. So with Leeds United returning to the EPL after two seasons in the Championship, what are the chances that Leeds United and the other two promoted clubs can defy conventional wisdom and avoid relegation? What do the numbers say?

The Dataset

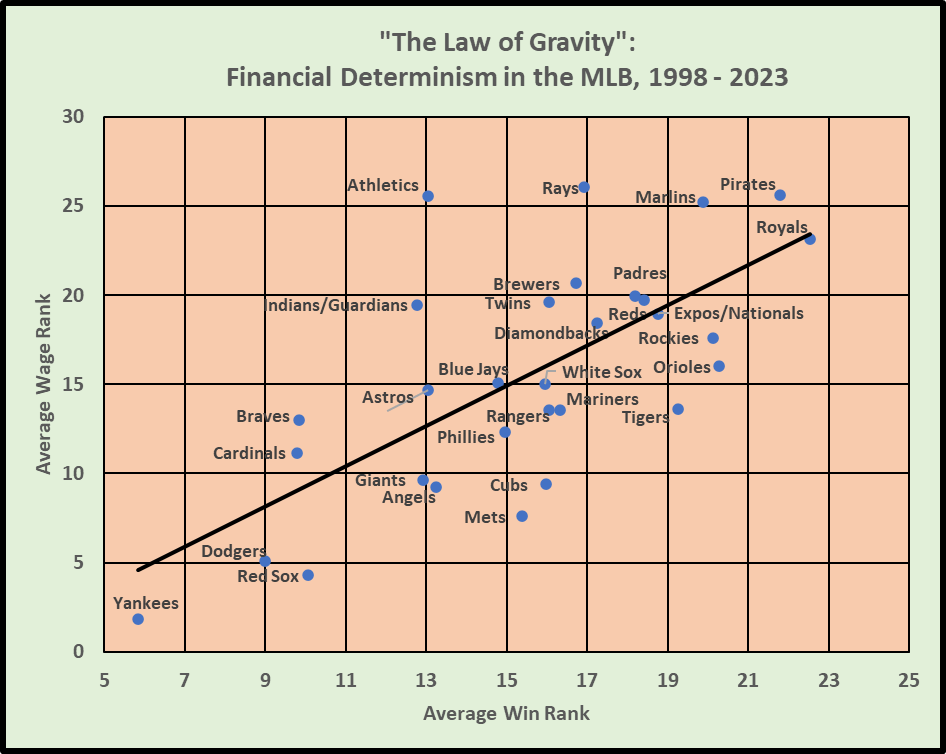

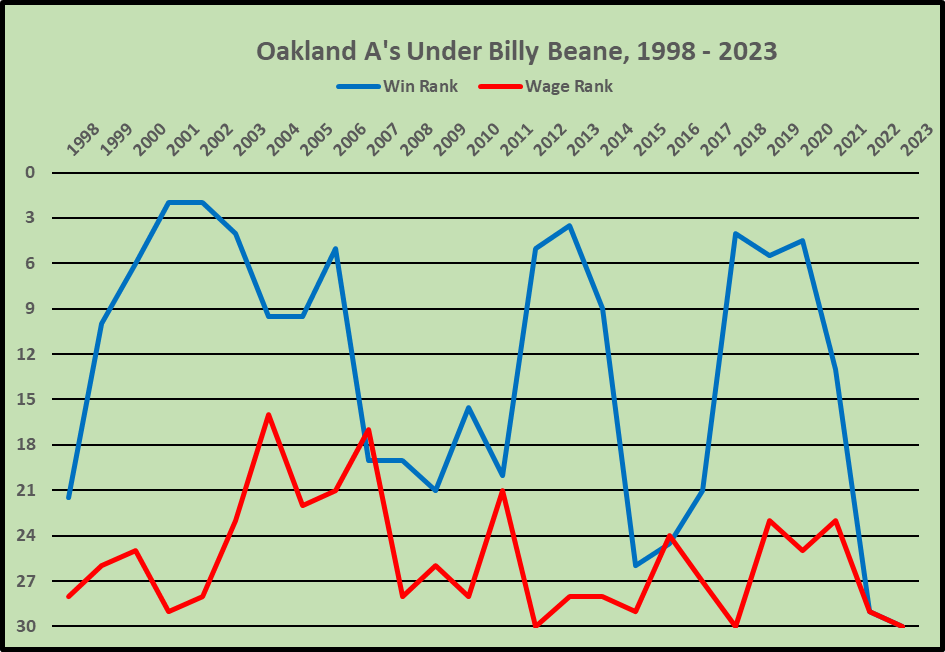

The dataset used in the analysis covers 30 years of the EPL from season 1995/96 to season 2025/26. The analysis has begun in 1995/96 which was the first season that the EPL adopted its current structure of 20 clubs with three clubs relegated. Note that there were only two teams promoted from the Championship in 1995/96. League performance has been measured by Wins, Draws, Losses, Goals For, Goals Against and League Points. In order to focus on sporting performance, League Points are calculated solely on the basis of games won and drawn, and exclude any points deductions for regulatory breaches. There is no case of any club being relegated solely because of regulatory breaches. Survival Rate is defined as the percentage of newly promoted clubs that were not relegated in their first season in the EPL. Relative Wages has been calculated as the total wage expenditure of clubs as reported in their company accounts relative to the median wage expenditure of all EPL clubs that season (indexed such that 100 = median wage expenditure). This allows comparisons to be drawn across seasons despite the underlying upward trend in wage expenditure. Company accounts are not yet available for 2024/25 so there is no analysis of wage expenditure and sporting efficiency in the most recent EPL season. Total wage expenditure includes all wage expenditure not just player wages. Estimates of individual player wages and total squad costs are available but their accuracy is unknown and limited to recent seasons only. A comparison of one such set of estimated squad wage costs and the wage expenditures reported in company accounts for the period 2014 – 2024 yielded a correlation coefficient of 0.933 which suggests that the “official” wage expenditures provide a very good proxy for player wage costs. Sporting Efficiency is defined as League Points divided by Relative Wages (and multiplied by 100). Sporting Efficiency is a standardised measured of league points per unit of wage expenditure across seasons that attempts to capture the ability of clubs to transform financial expenditure into sporting performance which, when all is said and done, is the fundamental transformation in professional team sports and at the heart of the Moneyball story as to how teams can attempt to offset limited financial resources by greater sporting efficiency.

League Performance of Newly Promoted Clubs

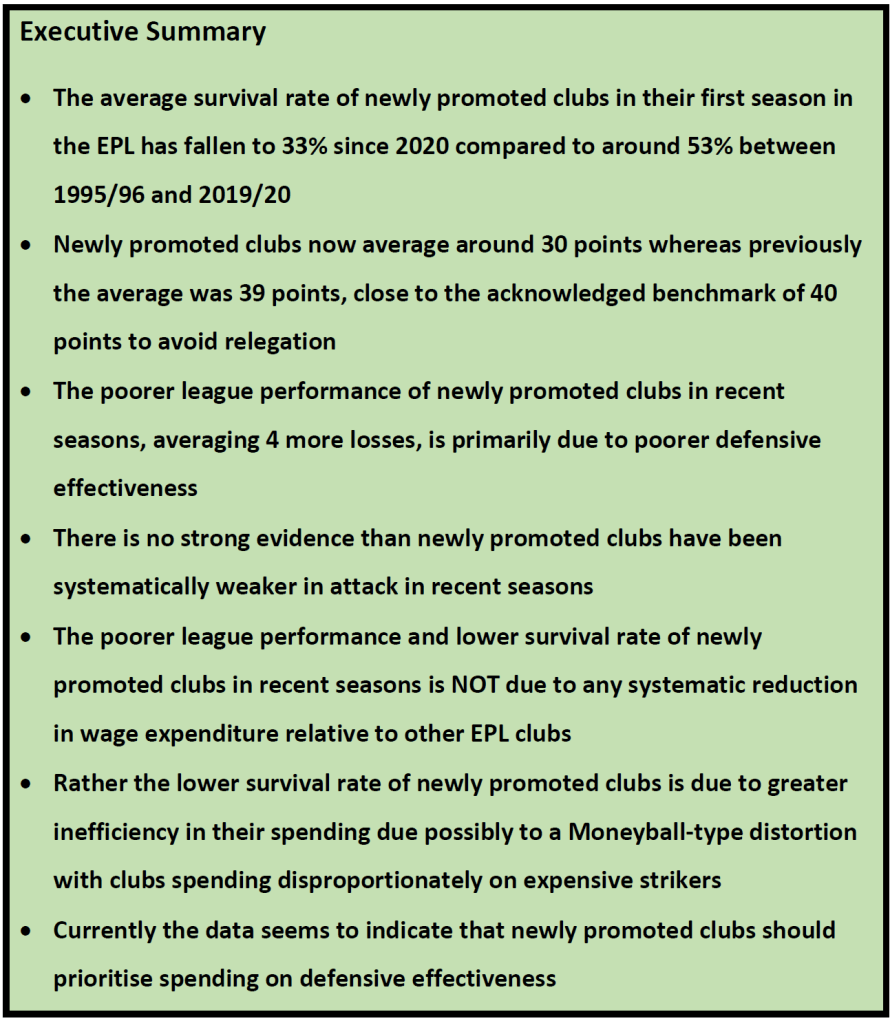

Table 1 summarises the average league performance of newly promoted clubs over the last 30 seasons of the EPL, broken down into 5-year sub-periods in order to detect any long-term trends over time. In addition, the proposition that the average league performance has deteriorated in the last five seasons compared to the previous 25 seasons has been formally tested statistically using a t-test with instances of strong evidence (i.e. statistical significance) of this deterioration indicated by asterisks (or a question mark when is marginally weaker). The key points to emerge are:

- There is no clear trend in wins, draws and losses by newly promoted clubs between 1995/96 and 2019/20 but thereafter there is strong evidence that newly promoted clubs are winning and drawing fewer games and, by implication, losing more games.

- Newly promoted clubs averaged 4 more losses since 2020 compared to previous seasons with an average of 22.5 losses in the last five seasons as opposed to an average of 18.7 losses in previous 25 seasons.

- The poorer league performance in recent seasons represents a reduction in average league points from 39.0 (1995/96 – 2019/20) to 30.5 points (2020/21 – 2024/25).

- Given that the acknowledged benchmark to avoid relegation is 40 points, not surprisingly the survival rate of newly promoted clubs has declined in the last five seasons to only a one-in-three chance of survival (33.3%) compared to a slightly better than one-in-two chance (56.8%) in the previous 25 seasons.

- The data suggests strongly that the primary reason for the decline in league performance and survival rates of newly promoted clubs in the last five seasons has been weaker defensive play, not weaker attacking play. Newly promoted clubs averaged 61.1 goals against in seasons 1995/96 – 2019/20 but this rose to 73.8 goals against in the last five seasons which represents very strong evidence of a systematic change in the defensive effectiveness of newly promoted clubs. In stark contrast, the change in goals for has been negligible with a decline from 40.5 (1995/96 – 2019/20) to 38.8 (2020/21 – 2024/25) which is more likely to be accounted for by season-to-season fluctuation rather than any underlying systematic decline in attacking effectiveness.

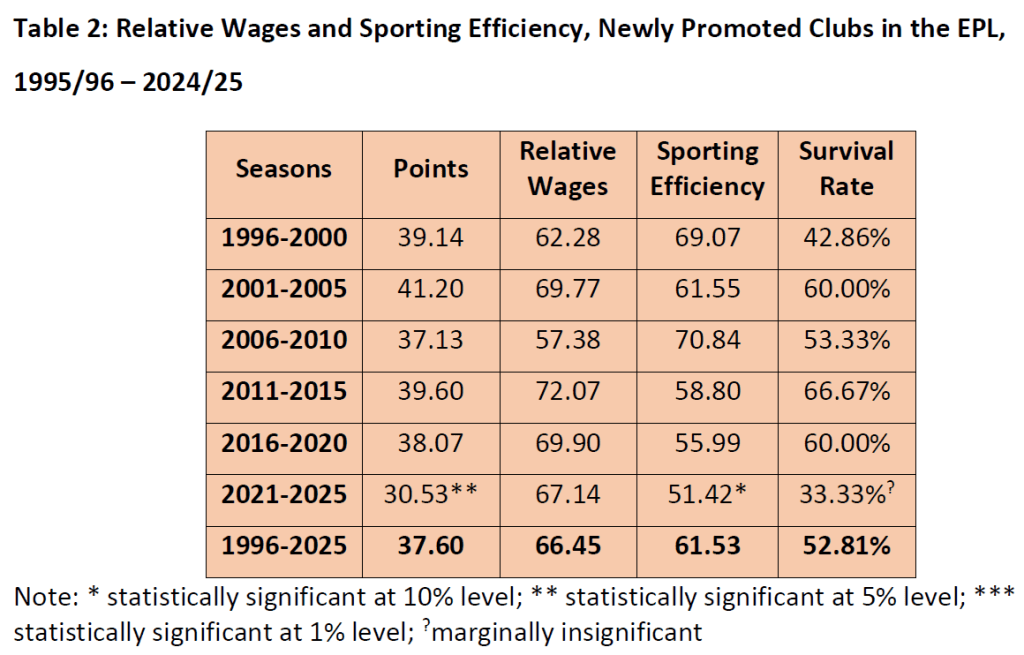

Wage Costs and Sporting Efficiency of Newly Promoted Clubs

It has been frequently argued that the recent decline in the league performance and survival rates of newly promoted clubs is due to an increasing gap in financial resources between established EPL clubs and the newly promoted clubs. Table 2 addresses this issue. There is absolutely no support for newly promoted clubs being more financially disadvantaged relatively compared to their predecessors. There has been virtually no change in the relative wage expenditure of newly promoted clubs in the last five seasons which has averaged 67.1 compared to 66.3 in the previous 25 seasons. The lower survival rate in recent seasons is NOT due to newly promoted clubs spending proportionately less on playing talent.

There is a very simply equation that holds by definition:

League Performance = Relative Wages X Sporting Efficiency

Since their league performance has declined but the relative wage expenditure of newly promoted clubs has stayed more or less constant, then their sporting efficiency MUST have declined. Table 2 suggests that there may have been a downward trend in the sporting efficiency in newly promoted clubs in the last 15 seasons. In addition, there is strong evidence that there has been a systematic downward shift in the sporting efficiency in the last five seasons to 51.4 compared to the previous average of 63.2 (1995/96 – 2019/20). On its own, this is merely a statement of the obvious dressed up in mathematical and statistical formalism. Newly promoted clubs are performing worse on the pitch as a result of spending less effectively. The crucial question is why league performance and sporting efficiency have declined. The answer may lie in reflecting on the fact that, as we discovered in Table 1, the reason for the poorer league performance is primarily due to poorer defensive effectiveness not poorer attacking effectiveness. Newly promoted clubs seem to be buying the same number of goals scored with the same relative wage budget as in previous seasons but at the cost of buying less defensive effectiveness and conceding more goals. This is consistent with a Moneyball-type distortion in the EPL player market with a premium paid for strikers that may not be fully warranted by current tactical developments in the game. The numbers would support newly promoted clubs giving a higher priority to defensive effectiveness in their recruitment and retention policy and avoiding spending excessively on expensive strikers, particularly those with little experience of playing and scoring in the top leagues.